Build business Credit Like a Boss.

Fund Your Business Like a Pro.

Helping You Establish & Grow Credit in Your Business Name!

At Currency Care Consulting, we help business owners build strong, credible business credit profiles that position them for long-term funding, vendor approvals, and growth—without relying on personal credit.

Why It Matters

Build business credit in your business’s name and EIN, not your Social Security number

Protect your personal credit while growing access to business capital

Position your company for long-term success, partnerships, and scalability

STARTER: FOUNDATION BUILDER

-

Clients starting from scratch.

-

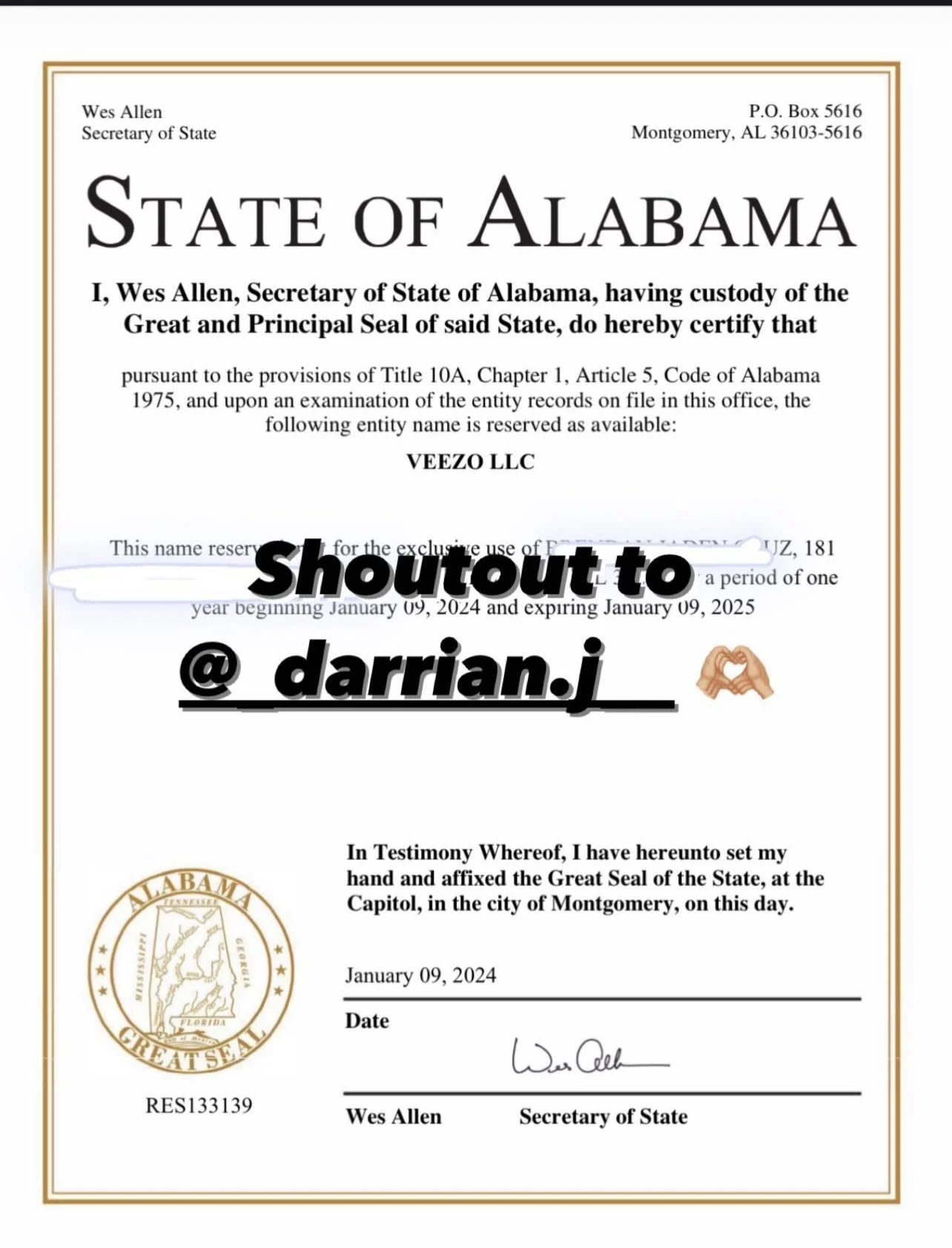

Business structure guidance (LLC setup, EIN, business bank account)

Business name + domain consultation

Business email + phone setup

DUNS Number application

Business address (virtual or physical) setup guidance

Business licensing assistance (state/city)

NAICS code assignment

Tier 1 vendor recommendations

Business credit basics education

Everything in Advanced Package

-

Coming Soon!!

Intermediate: CREDIT READY

-

Clients with an LLC and basic structure already in place.

-

Includes:

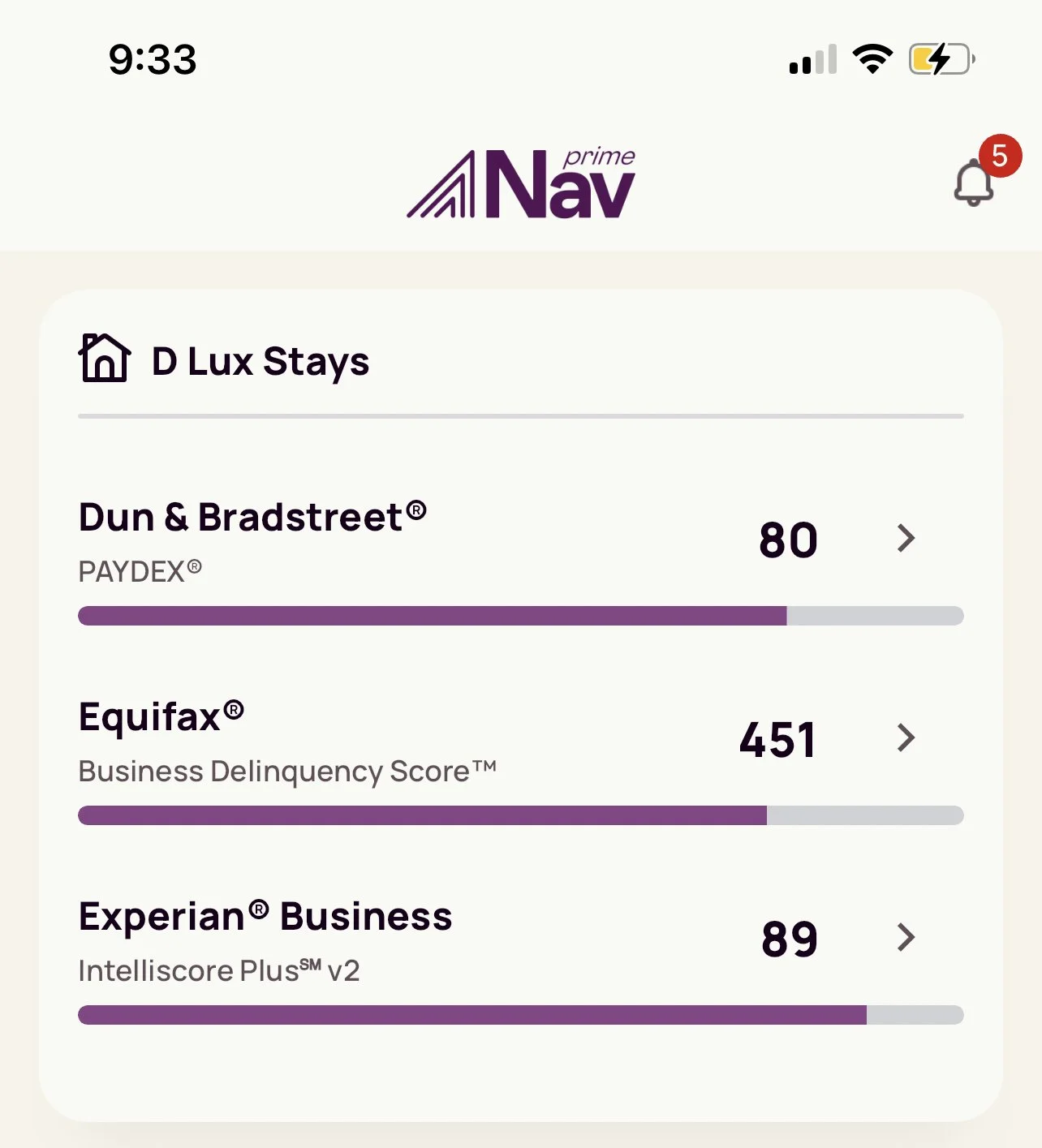

Business credit report audit (D&B, Experian, Equifax)

DUNS verification

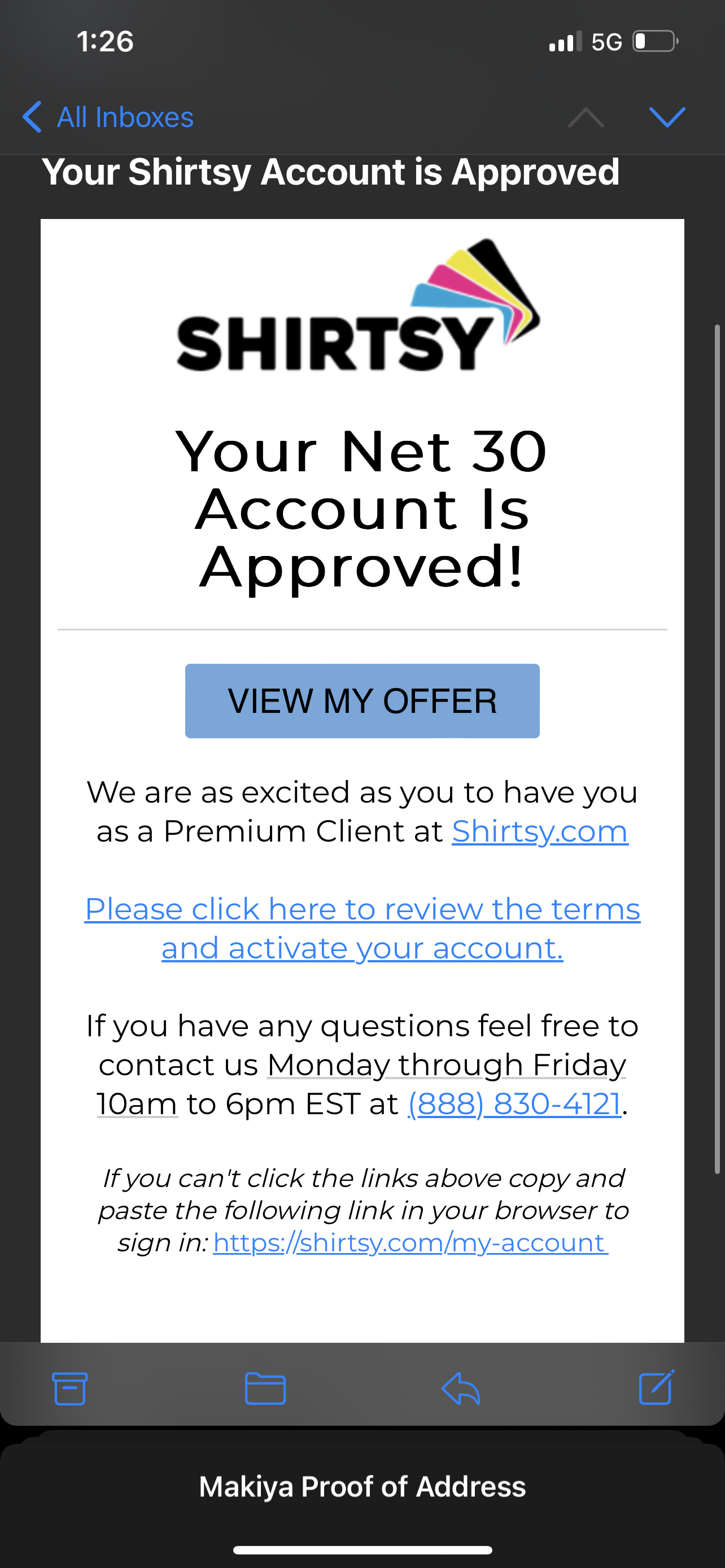

Net 30 vendor account setup (Tier 1 & 2)

Business credit monitoring setup

Establishing trade lines and payment strategy

Business funding readiness check

Personalized 90-day business credit roadmap

-

Coming Soon!!

Advanced: SCALE AND FUND

-

Clients with some credit history and looking for larger funding.

-

Includes:

Full audit of existing business credit profile

Dispute and correction of incorrect info

Tier 3+ vendor and revolving credit guidance

Business credit cards and LOC recommendations

SBA loan and alternative funding consultation

Business plan and financial projection templates

Lender match strategy

-

Coming Soon!!

RESULTS

*

RESULTS *

Get in touch.

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

FREQUENTLY ASKED QUESTIONS?

-

Business credit is a company’s ability to obtain financing based on its own financial history—separate from the owner’s personal credit. Strong business credit can help you secure funding, negotiate better terms with vendors, and scale your business more efficiently.

-

A business credit coach guides you through building, improving, and leveraging your business credit. This includes helping you set up your business properly, educating you on reporting agencies, showing you how to establish trade lines, and helping you access funding options.

-

The major business credit bureaus include Dun & Bradstreet, Experian Business, and Equifax Business. We help you understand how to get listed and manage your scores with each.

-

Business credit is tied to your business's Employer Identification Number (EIN), while personal credit is tied to your Social Security Number (SSN). They are evaluated separately and affect different aspects of your financial life.